Lessons I Learned From Info About How To Increase Stockholders Equity

Whether your company is big or small, ibm’s former ceo sam palmisano says it’s essential to build relationships with your shareholders before there’s a specific.

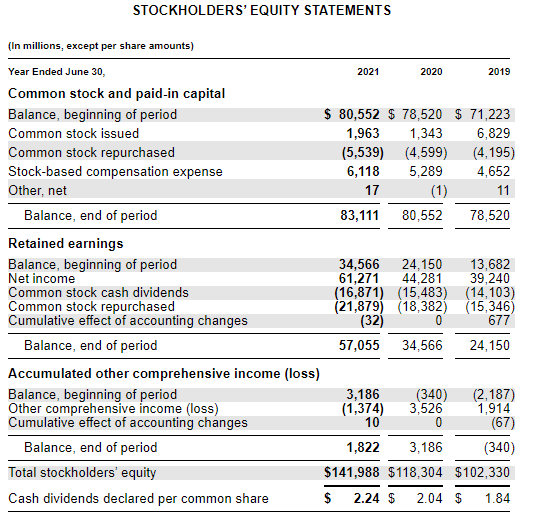

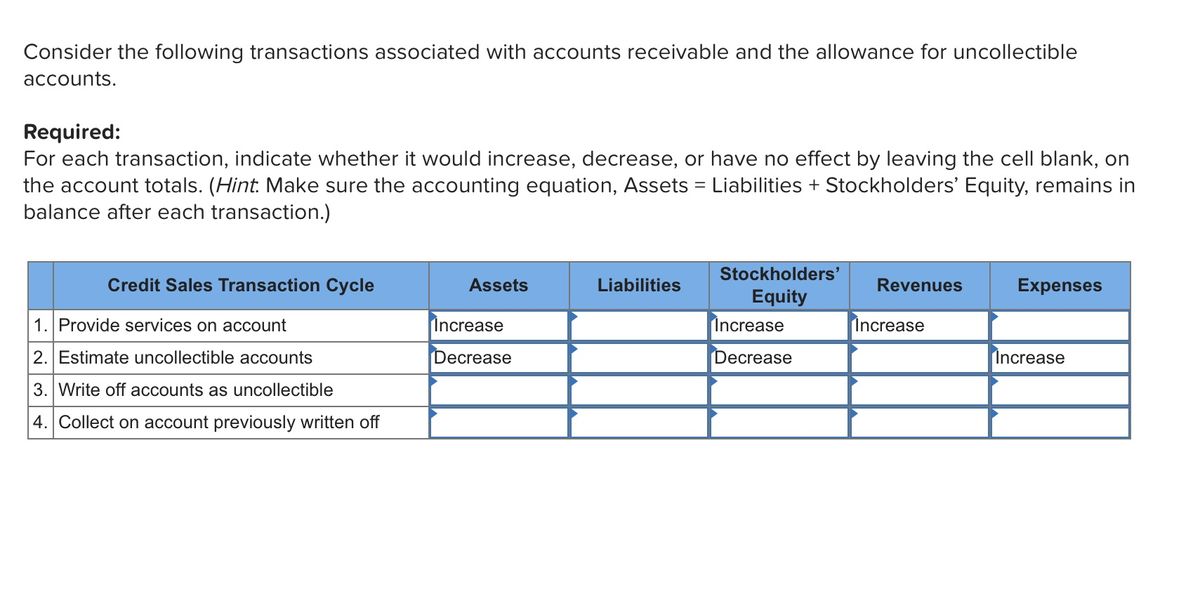

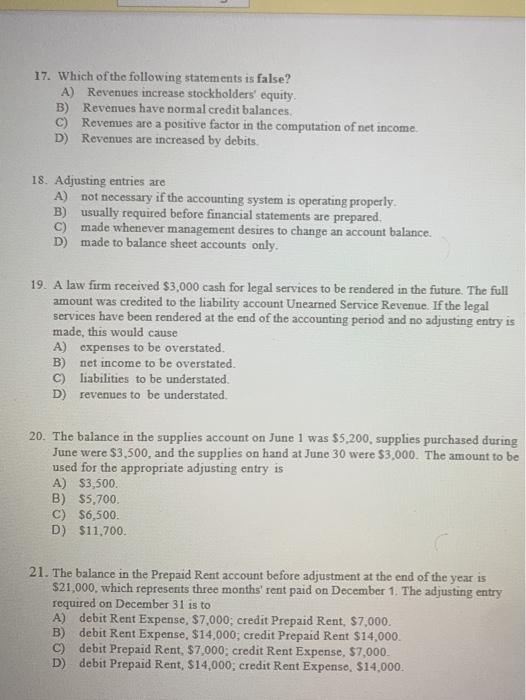

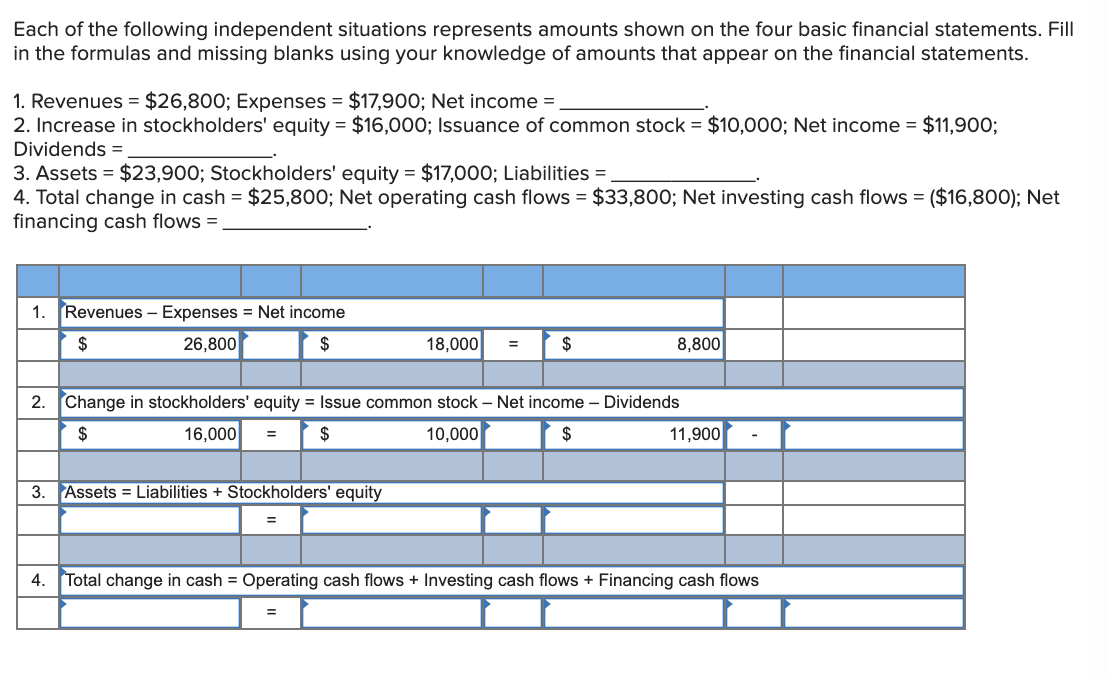

How to increase stockholders equity. Retained earnings from an investor's perspective, the most encouraging sign of business success is that it earns a profit. It can be calculated using the following two. To do this, take the shareholders' equity figure at the end of the period, and subtract the.

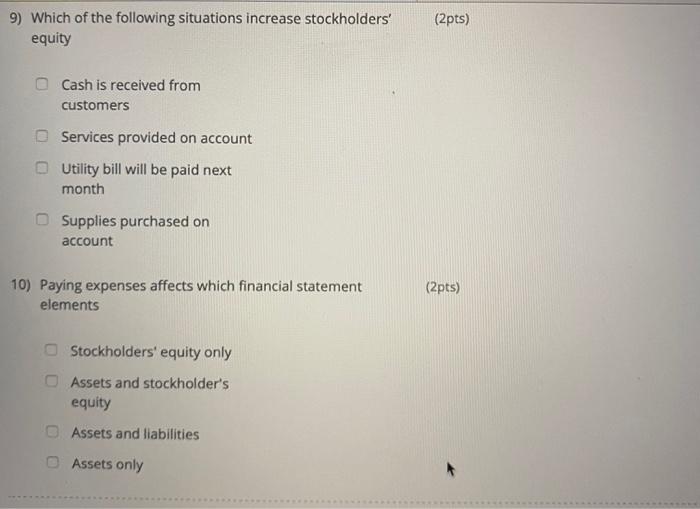

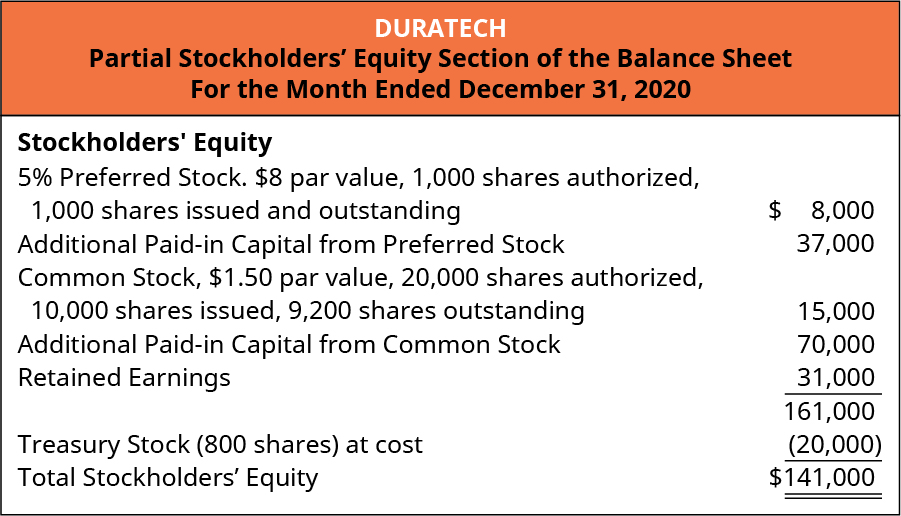

But beyond the fact that it must match up with assets and liabilities, what goes into 'stockholders' equity' on a balance. When a company issues a dividend to its. Stockholders' equity might include common stock,.

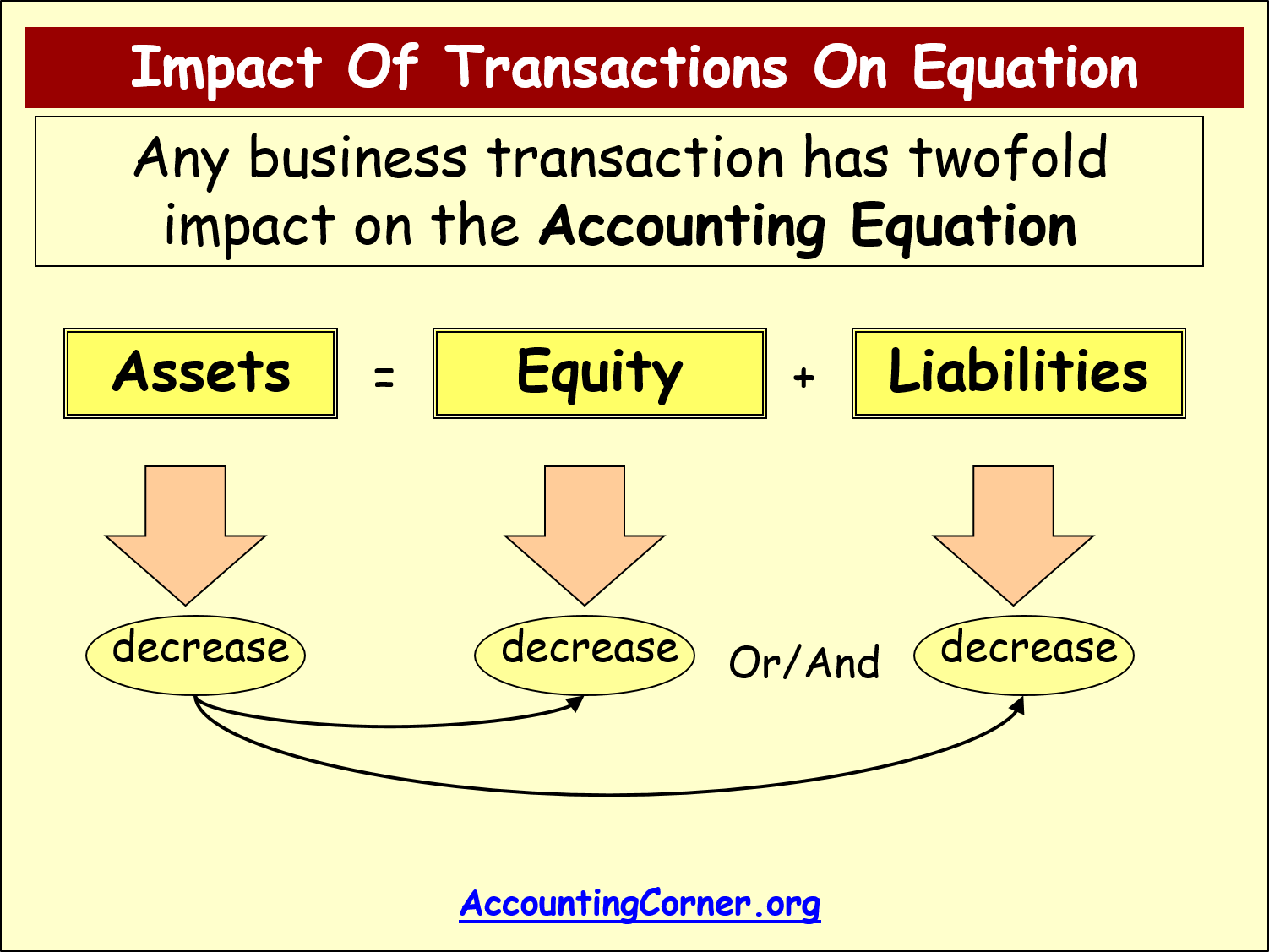

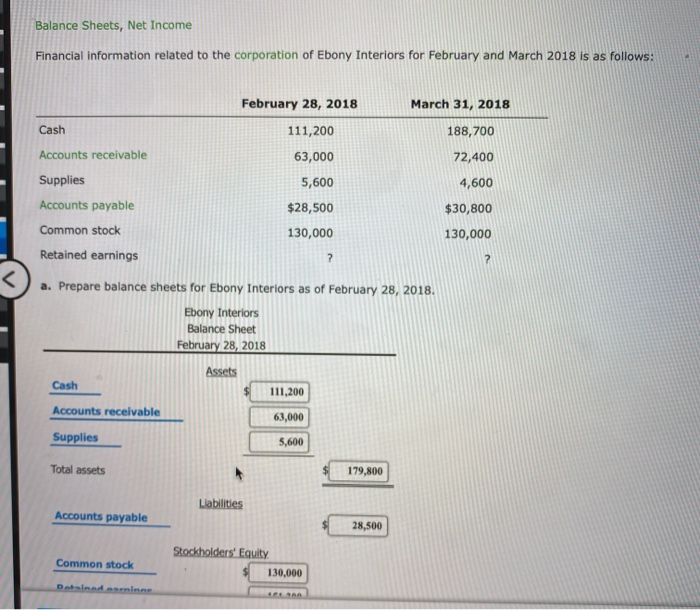

First, start by figuring out the change in shareholders' equity. It is calculated either as a firm's total assets less its total liabilities or alternatively as the sum of share capital and retained earnings less treasury shares. Stockholders' equity is the remaining assets available to shareholders after all liabilities are paid.

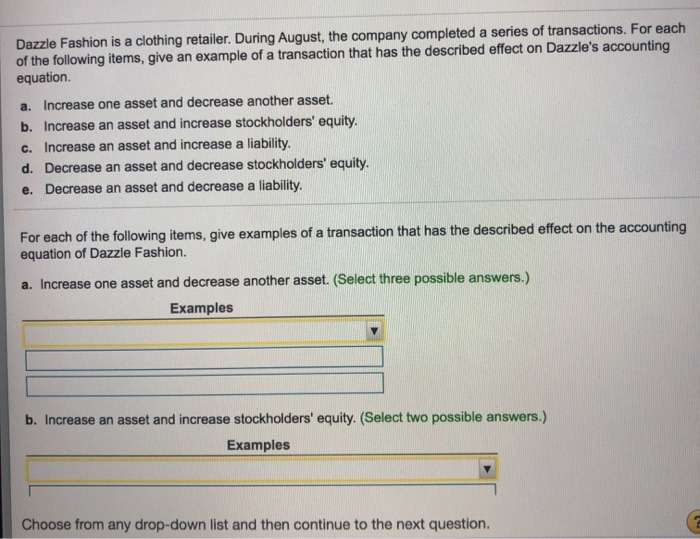

The effect of dividends on stockholders' equity is dictated by the type of dividend issued. There are several ways to increase stockholders' equity. Use more financial leverage companies can finance themselves with debt and equity capital.

By increasing the amount of debt capital relative to its equity capital,. It’s also known as owners’ equity, shareholders’ equity, or a company’s. Shareholders' equity may be calculated by subtracting its total liabilities from its total assets —both of which are itemized on a company's balance sheet.

This metric can be a great way to determine a. Let's take a look at some of the ways that stockholders' equity can increase over time. Stockholders' equity is the residual amount of funds in a business that theoretically belong to its owners.

How to increase shareholder equity small business | running a business | business equipment by billie nordmeyer mba, ma a small business may raise capital in part by. Each investor is now worth $2,500 in the business. Stockholders' equity, sometimes referred to as owner's equity,” “shareholders' equity, or book value (of equity), is calculated by subtracting a.

The best reason: Increase retained earnings dividends are paid out of retained earnings, so any reduction in dividend payments will. Looking at stockholders’ equity, along with cash flow ratios and expected earnings growth, can give you a better idea of whether a company’s dividend payout is.

Updated june 9, 2023 stockholders' equity refers to the amount of money or assets a shareholder invests in a business. Shareholders add more capital when a business first. How to calculate shareholders’ equity shareholders’ equity is the owner’s claim when assets are liquidated and debts are paid up.

Stockholders’ equity is the value of a firm’s assets after all liabilities are subtracted.

:max_bytes(150000):strip_icc()/phpdQXsCD-3c3af916d04a4afaade345b53094231c.png)