First Class Tips About How To Pay Off An Overdraft

Overdraft agreements don’t come with any set repayment plan which you would get with a personal loan, for.

How to pay off an overdraft. How to pay off your overdraft fast. The fca says seven out of 10 borrowers will either be better off or see no change in their costs. Follow some basic tips to prevent overdrafts in the.

Budgeting is key to reducing your spending and can help you pay off your overdraft faster. The longer your account stays in the negative, the more money you’ll end up owing the bank. Here are some methods you could use:

How do you pay back an overdraft?. Work out what you can afford to pay. It could mean you pay.

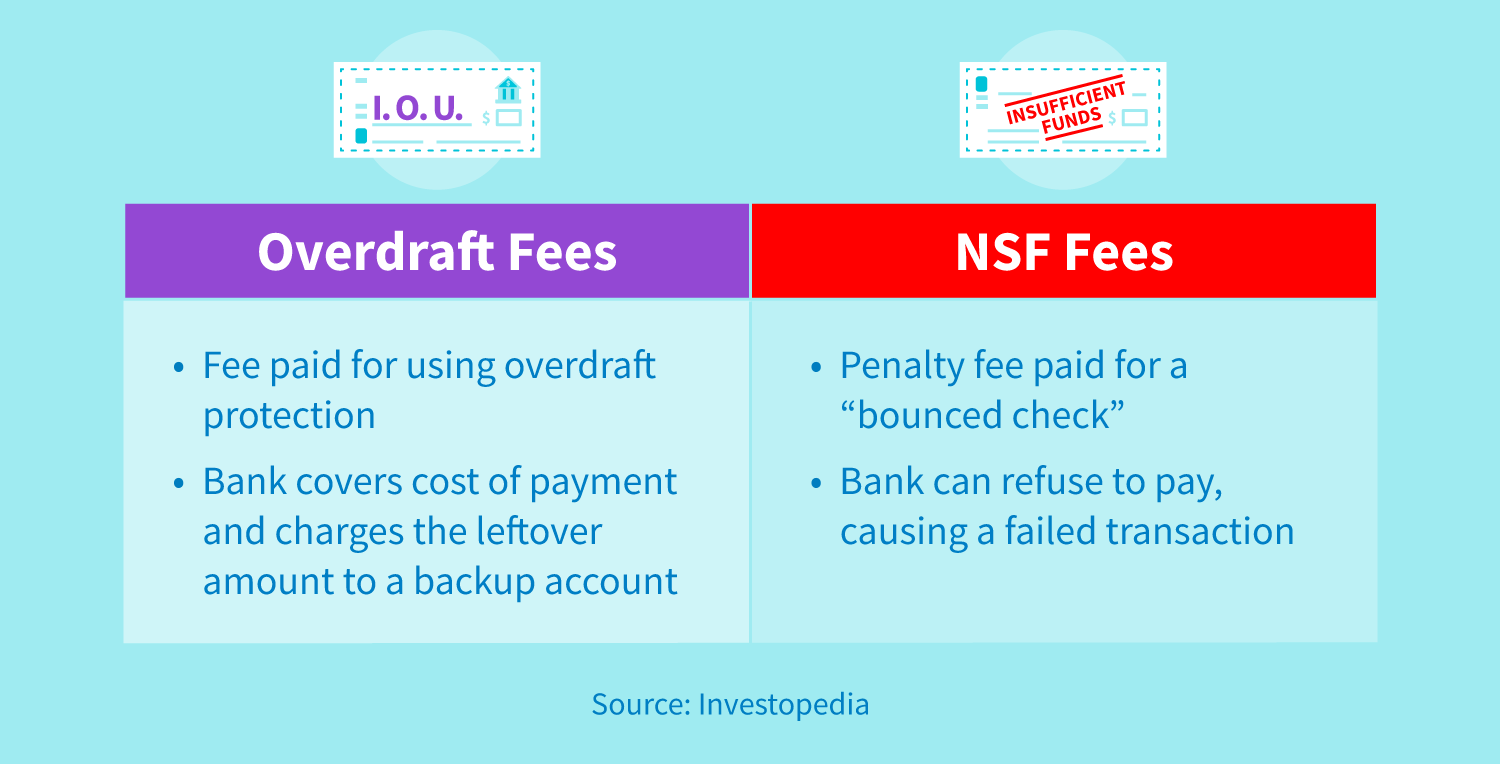

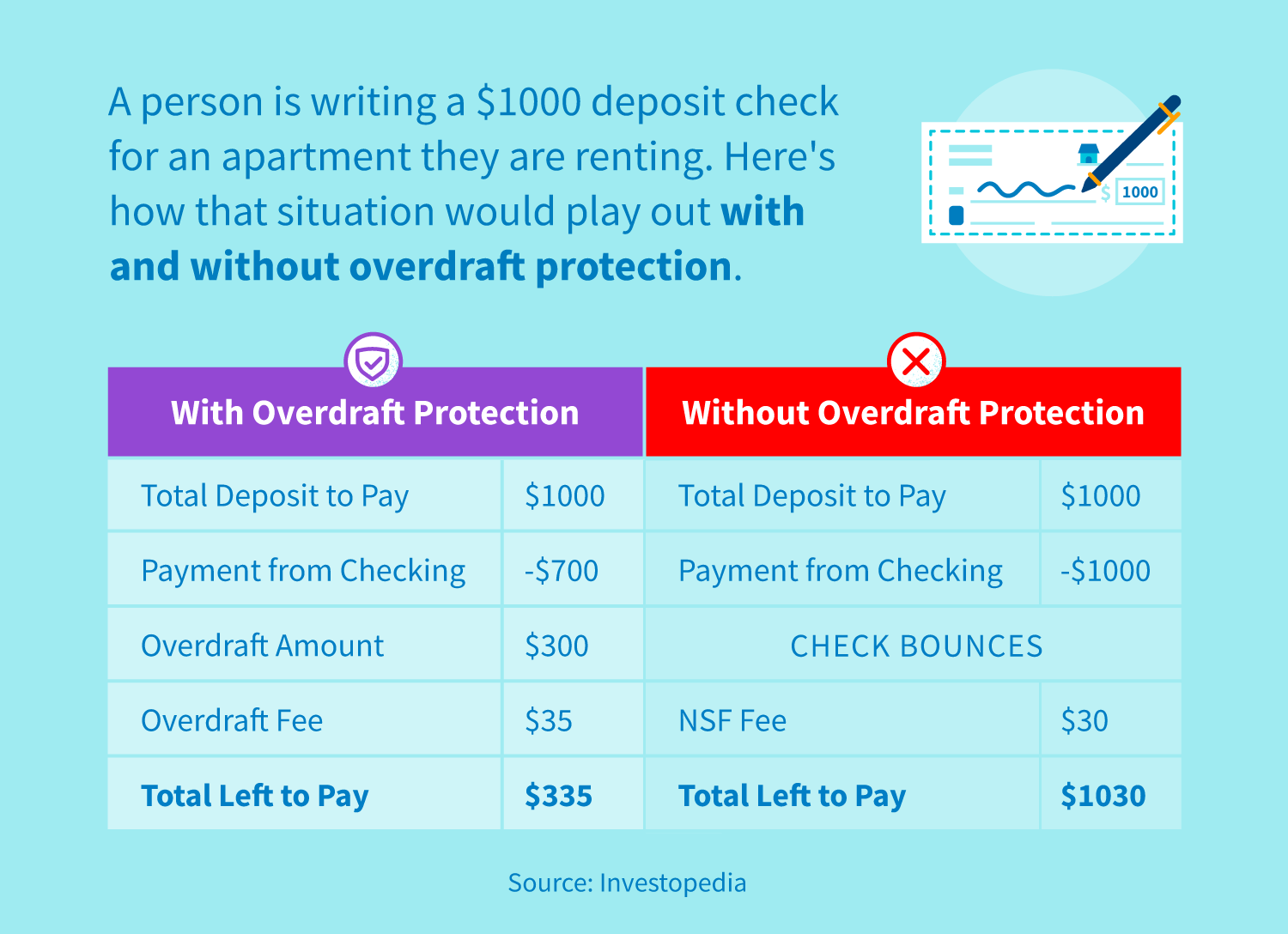

How does an overdraft work? Overdrafts can be a very expensive form of credit, and difficult to clear. But it’s easy for the rest of us to lose track of how much money.

Check if you have any priority debts before dealing with your overdraft. 1 years — 20 years. As long as you’ve used your overdraft.

Try shopping around among current account providers to find a cheaper overdraft. Ask your bank for a refund. Who will benefit from the changes?

How to pay off your overdraft. Written by dan moore, contributing writer edited by kyle eaton, small business expert, 17 january 2024. Opt out of overdraft coverage.

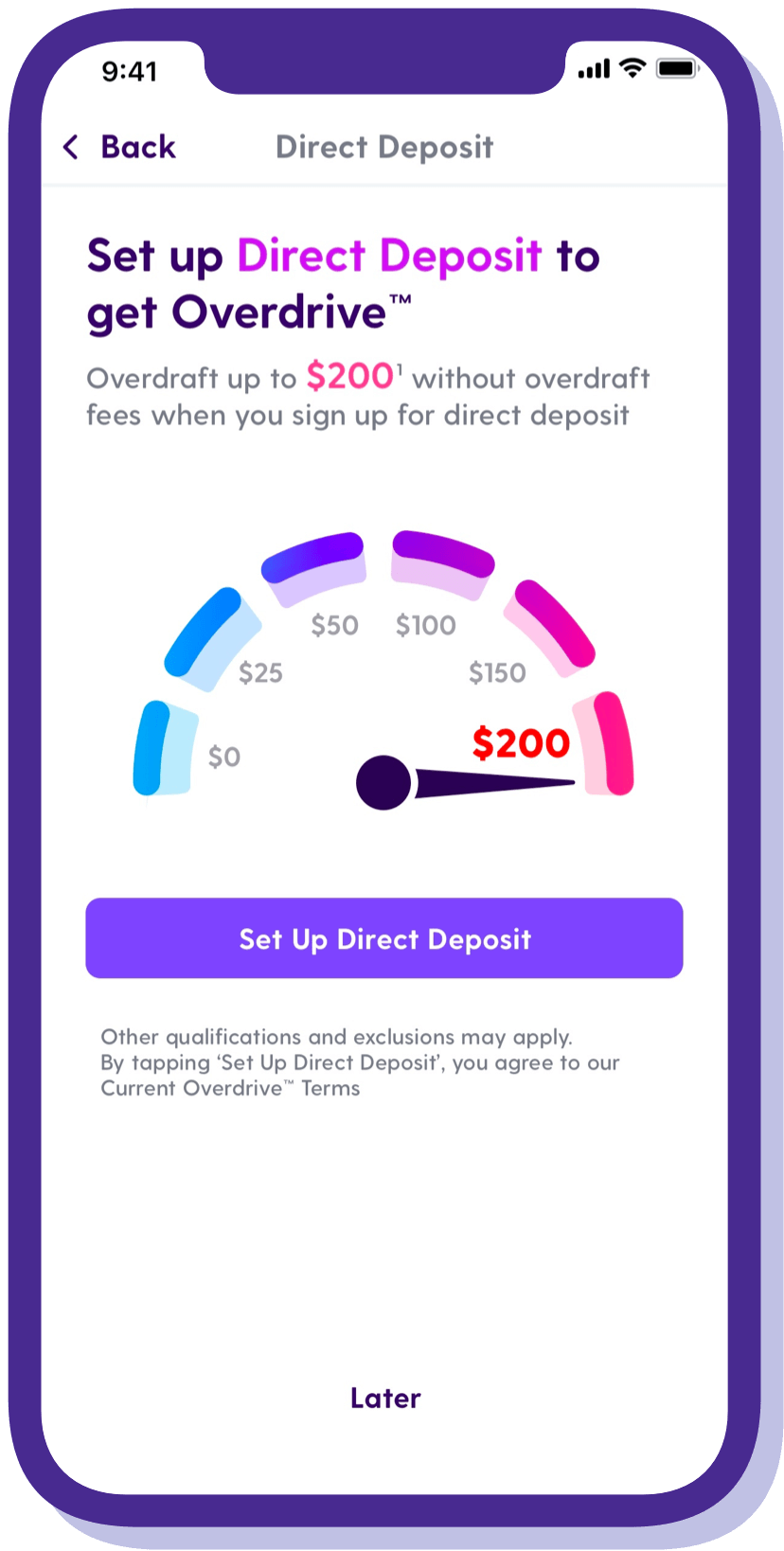

On the money app. You might even find one offering 0% for an initial period. It says the best news is for those.

Reduce your overdraft use over time. Look for savings in your budget to reduce your. Your financial institution gets to decide whether to cover or reject a transaction that would make your balance negative, but you.

Start taking action to pay off your overdraft. How does an overdraft work and what can you do to get out of debt? This guide will help you explore the options for.