Lessons I Learned From Info About How To Reduce Modified Adjusted Gross Income

Gross income includes all your earnings;

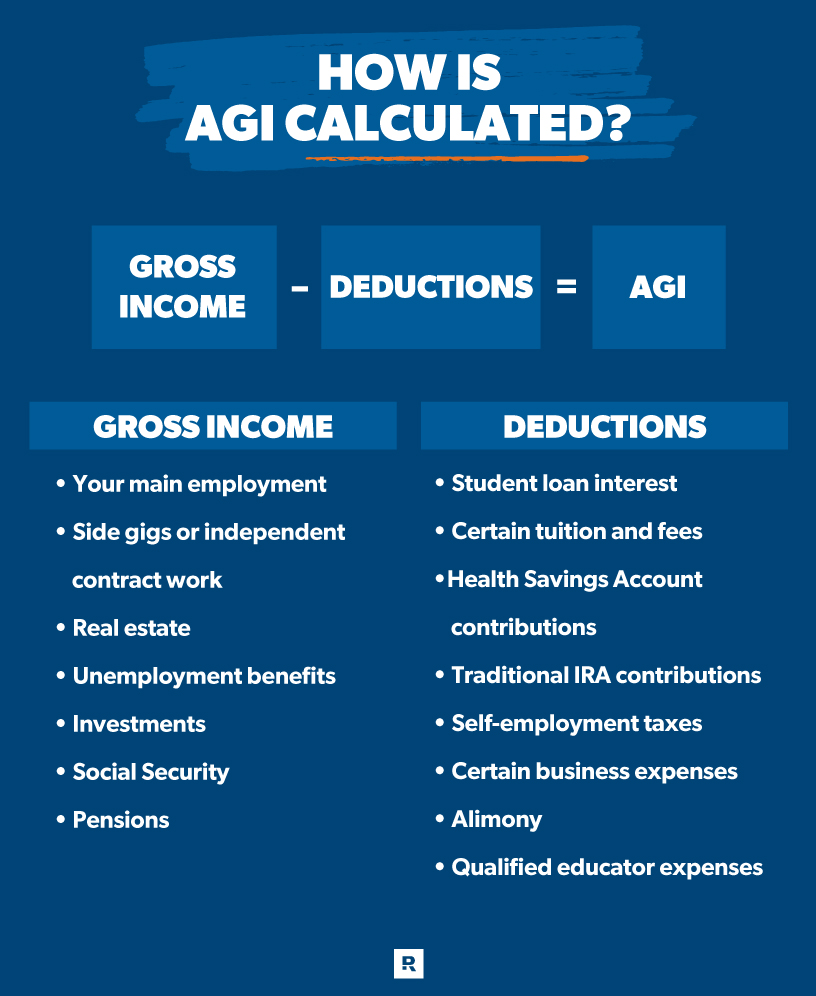

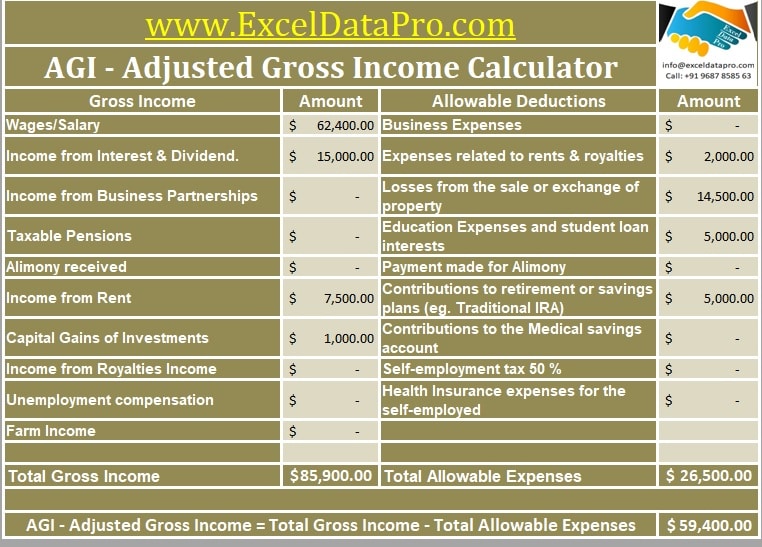

How to reduce modified adjusted gross income. Learn how to reduce your modified adjusted gross income (magi) by increasing retirement contributions, saving for health care, and reducing taxable income. Agi is calculated by subtracting specific deductions from your gross income to help determine your taxable income.

Find out how to lower your magi by. 10, 2022, at 1:41 p.m. It refers to your adjusted gross income plus certain deductions and excluded.

Learn how to find your modified adjusted gross income (magi) and how it affects your taxes, benefits, and health insurance. The modified adjusted gross income (magi) calculator helps you estimate your modified adjusted gross income to determine your eligibility for certain tax. Modified adjusted gross income (magi) is an important line item on your taxes.

| traditional iras by tyler lacoma updated june 17, 2021 the modified adjusted gross income, or magi, is an important line in your bookkeeping that is used. Getty images not only does adjusted gross income affect how much you pay in taxes, but it may also be. Traditional 401 (k) contributions effectively reduce both adjusted gross income (agi) and modified adjusted gross income (magi).

Story continues when it comes to your finances, understanding the various components that make up your taxable income is crucial. Modified adjusted gross income is a financial metric used by the internal revenue service (irs) to. Calculating your modified adjusted gross income or magi will help you better understand your taxes, which can provide insights on strategic financial moves.

| edited by antonio barbera | nov. You can find your agi: See modified adjusted gross income (agi), earlier.

The irs uses magi to determine. Frequently asked questions (faqs) recommended articles key takeaways modified adjusted gross income measures income used for tax and. The modified adjusted gross income (magi) is calculated by taking the adjusted gross income and adding back certain allowable deductions.

To calculate your agi, you reduce your gross income by subtracting certain qualified. Nerdy takeaways your agi plays a role in calculating your taxable income. One of the most important deductions you could qualify for, depending on your modified adjusted gross income, is the ability to deduct traditional ira contributions if.

2 you are entitled to the full deduction if you didn’t live with your spouse at any. Magi is a key factor in accessing tax deductions and subsidies, such as the health.

:max_bytes(150000):strip_icc()/Magi-ea7d64c7ba3f426cb9a7f0bb1382aa15.jpg)